by HMRCInvestigations | Company Tax Investigation, Uncategorized

An application for a closure notice in respect of an HMRC inquiry into the appellant’s domicile status was refused, as HMRC was not bound by its previous confirmation of the taxpayer’s domicile. The appellant, a UK national with a UK domicile of origin, spent...

by HMRCInvestigations | Income Tax Investigations, Uncategorized

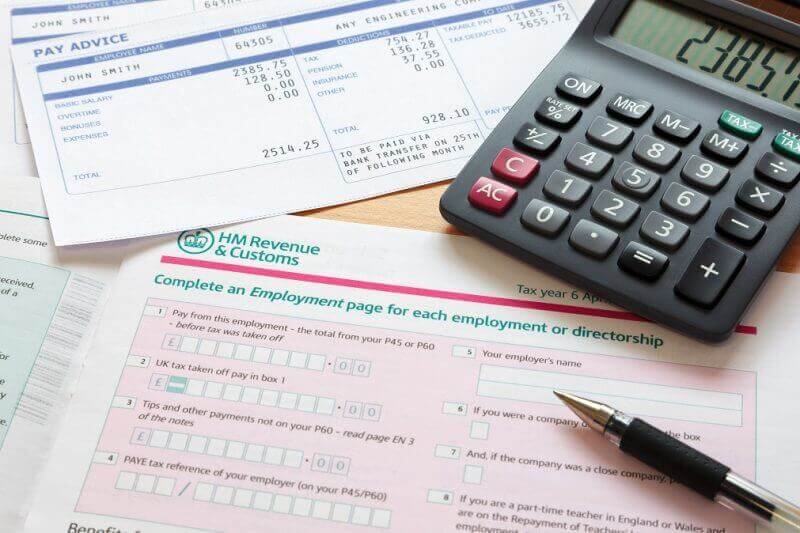

The difficulties suffered by the appellant during and following the prolonged illness and eventual death of her parents constituted a reasonable excuse for the purposes of an appeal against a penalty for the late filing of her tax return. HM Revenue and Customs (HMRC)...

by HMRCInvestigations | VAT Inspections

A partnership’s ‘paper’ (i.e. non-electronic) tax return was held to have been submitted before the statutory filing deadline, despite HM Revenue and Customs contending that the return had been filed late and seeking penalties for its late submission. The appellant...

by HMRCInvestigations | Company Tax Investigation, Uncategorized

Changes to the taxation of dividends have reduced the tax advantages associated with operating as a company. Add into the mix the additional burdens imposed on companies – such as the need to file accounts and an annual confirmation statement at Companies House – and...