by HMRCInvestigations | Company Tax Investigation, Uncategorized

An application for a closure notice in respect of an HMRC inquiry into the appellant’s domicile status was refused, as HMRC was not bound by its previous confirmation of the taxpayer’s domicile. The appellant, a UK national with a UK domicile of origin, spent...

by HMRCInvestigations | Income Tax Investigations, Uncategorized

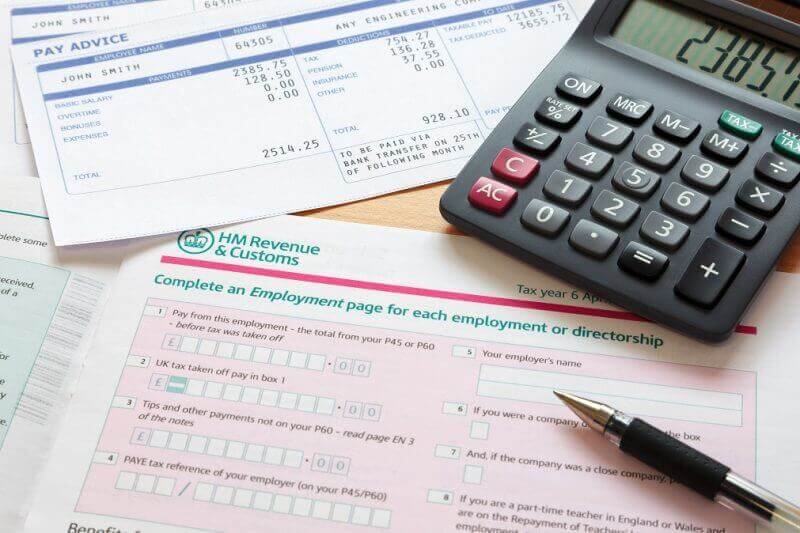

The difficulties suffered by the appellant during and following the prolonged illness and eventual death of her parents constituted a reasonable excuse for the purposes of an appeal against a penalty for the late filing of her tax return. HM Revenue and Customs (HMRC)...

by HMRCInvestigations | Company Tax Investigation, Uncategorized

Changes to the taxation of dividends have reduced the tax advantages associated with operating as a company. Add into the mix the additional burdens imposed on companies – such as the need to file accounts and an annual confirmation statement at Companies House – and...